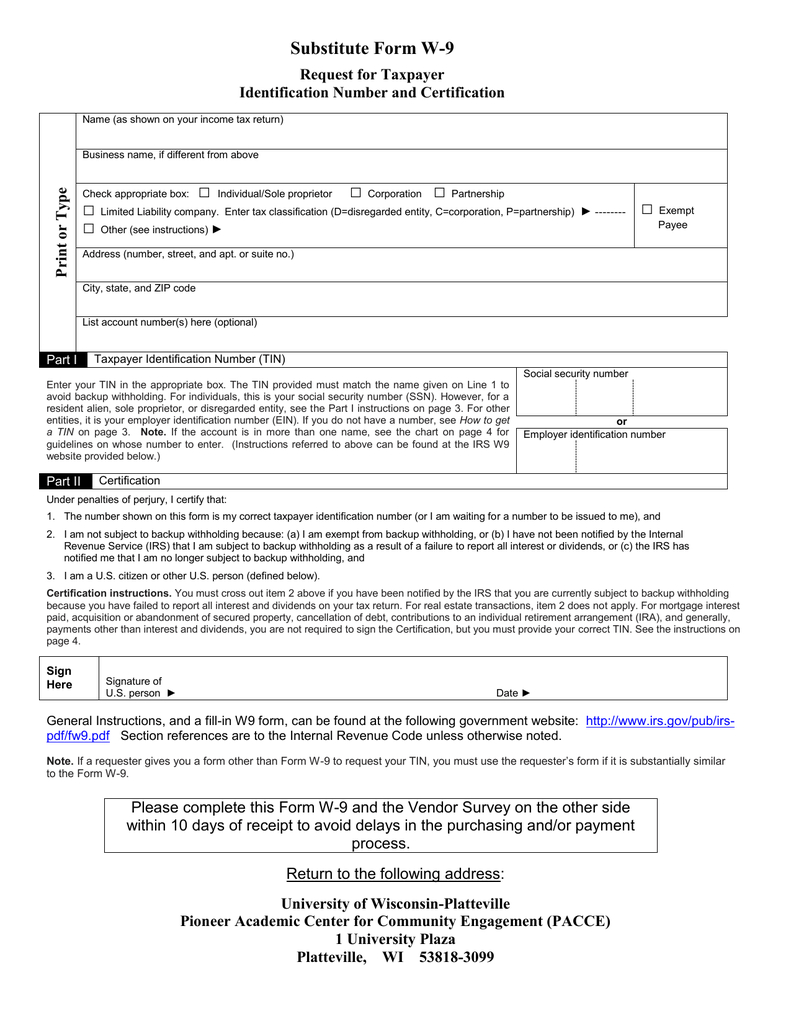

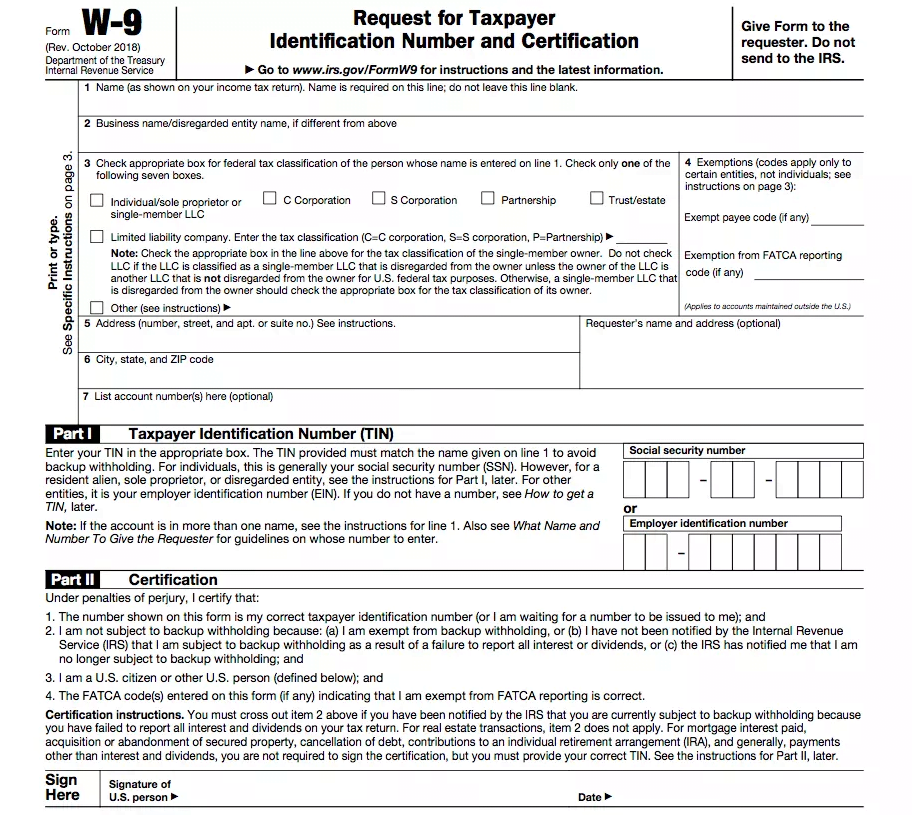

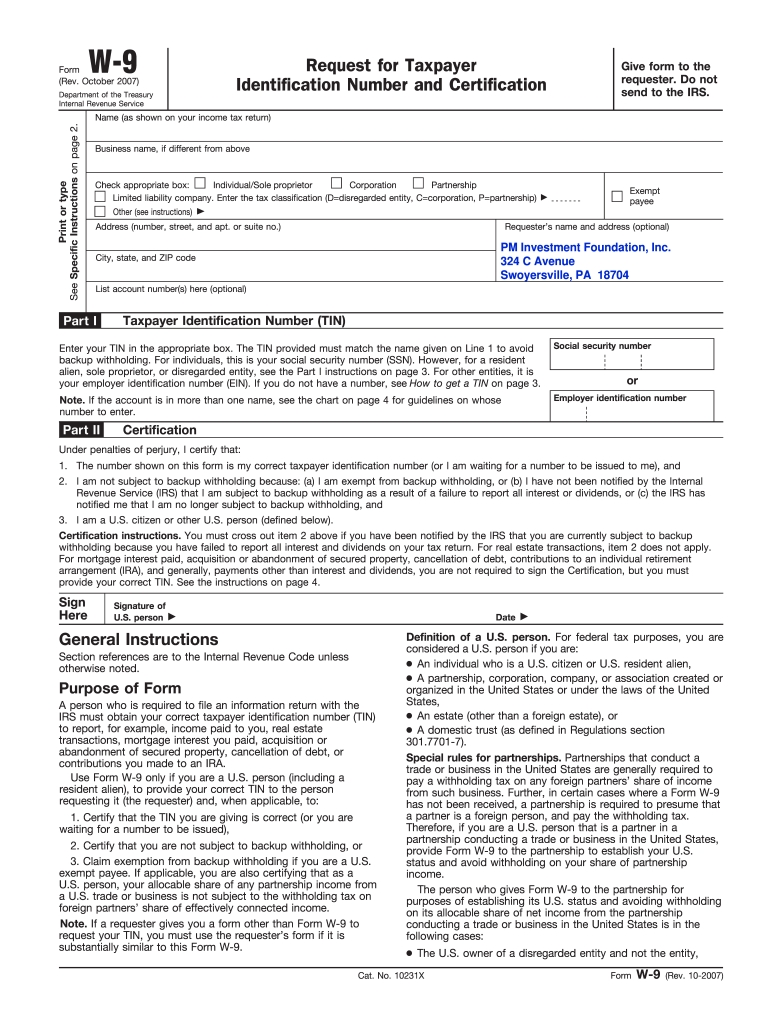

By signing it you attest that: The TIN you gave is correct. This is where you sign when required.įorm W-9 is officially titled Request for Taxpayer Identification Number and Certification. Remember, entering “Applied For” means you’ve already applied for a TIN or you intend to soon. Requestors of Form W-9 will have to deduct backup withholding from any payments that are subject to it until you provide your TIN. If you’re asked to complete Form W-9 but don’t have a TIN, apply for one and write “Applied For” in the space for the TIN, sign and date the form, and give it to the requester. Enter your SSN, EIN or individual taxpayer identification as appropriate. Some businesses have multiple accounts with a vendor and this line is available to specify which account this W-9 pertains to.

Irs w9 form zip#

If you discover that the requester has been using the wrong address or TIN for your business, let the requester know as soon as possible and provide the correct information.Įnter your city, state and zip in line 6. If you have already provided the requester an address and this is a new address write “new” at the top.

Irs w9 form code#

Refer to the instructions provided with Form W-9 for the appropriate code to use if you believe your business is exempt from potential backup withholding. or related to payment cards or third-party network transactions. However, corporations aren’t exempt from backup withholding for payments: For attorneys’ fees or gross proceeds paid to attorneys for providing medical or health care services. Corporations are exempt from backup withholding for certain payments – – like interest and dividends with some exceptions. Usually, individuals aren’t exempt from backup withholding. Exemption codes are for those payments that are exempt from backup withholding. federal tax classification of the person whose name is entered on line 1. If you have a business name, trade name, doing business as name or disregarded entity name you can enter it on line 2 business name. If the owner of a single member LLC is also a disregarded entity, provide the name of the first owner that isn’t a disregarded entity. The name on line 1 should never be a disregarded entity – a single owner LLC. To clarify this point, the name on line 1 must match with the name the IRS associates with your TIN. If you are running a sole proprietorship you would enter YOUR name. These are the steps to correctly complete a Form W-9. This form is used to provide the correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example: Non-employee compensation real estate transactions mortgage interest acquisition or abandonment of secured property cancellation of debt and contributions to an IRA.

Now let’s get started.įorm W-9 is officially titled the Request for Taxpayer Identification Number and Certification. We’re recording this program and maintaining it in accordance with federal record keeping laws. No identification with actual persons (living or deceased), places, buildings and products is intended or should be inferred. This material isn’t official guidance.Īny stories, names, characters, and incidents portrayed in this production are fictional. The information presented here is current as of the day it was presented.

Irs w9 form how to#

Whether you’re filing or requesting Form W9 now or in the future, here are our answers to most asked questions about it.Welcome to this IRS video How to Complete Form W-9. It’s completely normal for anyone to have questions in their minds about Form W9. Just like any other IRS tax form, there is a lot that goes into Form W9. After all, Form W9 is- without a doubt-one of the easiest tax forms you can get done. It is easy to understand the use of Form W9 and so as filing it. In any tax situation, if the taxpayer identification number whether it be in the form of Social Security Number or Employer Identification Number is needed, Form W9 must be requested and filed to provide it. Having said that, the information needed to file Form 1099-MISC must be provided to the payer. Therefore, Form 1099-MISC must be filed to report income. The income can only be reported on Form W2 if the income is paid to an employee. When a company hires a contractor or a freelancer to do some work, the income paid must be reported in a different way than Form W2. The best example to this is the job between companies and freelancers. It is used in any tax situation where another part’s taxpayer identification number is needed. Form W9 is an IRS tax form that is used for providing taxpayer identification number to the requester.

0 kommentar(er)

0 kommentar(er)